Showing: 23 items

Refine By

April 01, 2024 | by Diebold Nixdorf

Explore case studies and learn how your peers leverage Diebold Nixdorf banking products and services for their success.

October 03, 2022 | by Helena Müller

Whether used for budgeting, convenience or just as a payment method consumers feel more confident with the emotional trust and economic value associated with cash, which goes beyond just the physical note in all industries.

September 08, 2022 | by Louise Coles

In addition to changing consumer behavior and the rise of challenger banks, digitization through data is playing a crucial role in the changes that are happening in the banking industry. In this blog we explore three drivers that are contributing to a more dynamic marketplace.

September 01, 2022 | by Scott Anderson

Let’s face it, gaining product information and advice, developing a financial plan and completing the transactional tasks required for one’s daily financial wellbeing won’t ever be as emotionally gratifying as other aspects of our daily lives. …or could it be?

June 13, 2022 | by Juergen Kisters

Be it driving growth or reducing costs, modern technology enables financial institution to transform their operations while fulfilling their consumers’ needs for innovation, security, and flexibility. Change must occur to meet the requirements of more digital-oriented consumers and compete with other digital-only competitors.

December 13, 2021 | by Jodi Neiding

Although digital and automated transactions are growing, it doesn’t mean that banks can’t provide unique experiences at these channels while maximizing opportunities to generate leads, cross-sell and reinforce cross-channel richness.

November 12, 2021 | by Habib Hanna

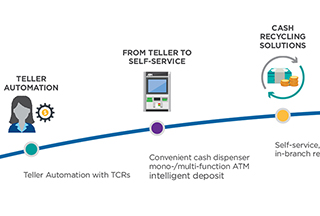

Despite the growing use of digital payments, cash will remain an important payment method; we’re seeing an increase in cash deposits, laying the foundation for a business case for cash recycling.

October 26, 2021 | by Anja Popp

Dive into the latest research on the types of consumers using your banking channels. We partnered with NielsenIQ to survey 12,000 people across 11 countries. Find out what they really want in a bank.

July 12, 2021 | by Scott Weston

How are you optimizing your ATM network from a placement perspective? The best locations are situated where your consumers are going on a daily basis for their everyday shopping needs. Continue reading for some tips to ensure you get the most out of your network.

June 14, 2021 | by Scott Weston

When building the foundation for a successful ATM strategy there are three key pieces of information you need to consider: Consumer Analysis, Market Analysis, and ATM Network Analysis. Each are equally important, yet very different. Careful analysis of these components will reveal areas of strength and areas for improvement in your ATM network.

May 03, 2021 | by Ludwig Simoen

In a cash recycling scenario, your own consumers are replenishing your ATMs for free. Are you taking advantage of it?